Certifications

ISOFP currently offers a wide range of course programs. Carefully engineered course outlines designed by highly accredited leaders in their respective fields guarantee that your learning experience with us will rival the best and reward you with the tools to advance in your career!

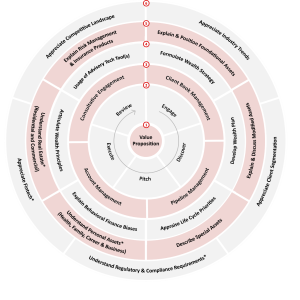

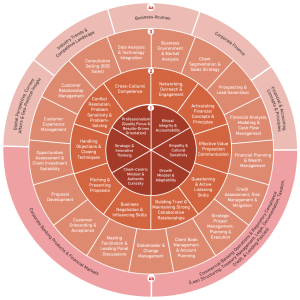

Courses have been designed with specific job competencies in mind, focusing on topics and subjects that will help with career advancement and professional development. ISOFP utilizes three Core Competency Wheels as the frameworks for learning structures, recognizing individual needs while respecting a consistent lateral outcome of success for all members. ISOFP currently offers the following 8 certification programs, conducted by different faculties & training companies globally.

PRIVATE BANKING & WEALTH MANAGEMENT

Our Private Banking & Wealth Management competency wheel focuses on the essential skills required to manage High-Net-Worth clients and their financial assets. This framework encompasses wealth planning, investment strategies, client relationship management, and regulatory compliance. It ensures that professionals are equipped to deliver personalized and effective financial solutions.

Legend:

1. Certified Wealth Management Advisor (CWMA)

A 5-day (40-hrs) program which creatively combines “knowledge learning” and “transformative learning” to provide an in-depth knowledge of domestic and international wealth management. The program begins with an overview of global wealth management market and transition to the domestic wealth management market. The CWMA program allows participants to:

- Learn key concepts in identifying target customers, market segmentation, customer acquisition, retention and value management.

- Learn and understand different wealth management products and services and be able to recommend the right investment mix based on the client’s needs.

- Understand the core principles of asset allocation, financial marketing, financial risk and management strategies.

- Be equipped with knowledge about tax planning methods and learn to effectively use financial instruments.

- Understand the legal arrangements with private wealth management, specifically preservation and succession.

- Understand and be able to explain concepts of insurance policies as well as core functions and business operations of family trusts.

2. Executive Certified Wealth Management Advisor (eCWMA)

Tailored for high-performing Financial Advisors looking to transition into accomplished wealth managers in the competitive industry, this 3-day Learning Journey comprises of three meticulously curated 1-day Workshops (21-hrs). Focusing on the systematic applications of the knowledge and skills through interactive workshops, case studies, and formative learning, this program is designed to equip the Financial Advisors in engaging with High-Net-Worth-Individuals with confidence. The 3 Workshops are as follows:

- Private Banking & Wealth Management Industry Dynamics (1 day)

What is the Private Banking industry all about? What is my Market Niche in Wealth Management industry? - Private Banking & Wealth Management Conversations (1 day)

How do I Find & Get High-Net-Worth Clients? What is my Personal Value Proposition? - Private Banking & Wealth Management Investment Strategies (1 day)

How can I provide Investment & Wealth Advice to High-Net-Worth Clients? What are the different Investment Strategies to discuss?

3. Certified Private Banking Advisor (CPBA)

An 8-week Asynchronous Online program actively running in China, which focuses on Mastering Core Competencies required of wealth managers, including both advisory skills and technical knowledge. Applying the latest in learning methodology by using the case study methodology subscribed by Harvard Business School, CPBA focuses on real-life case studies with intentional integration of technical skills, advisory skills and both product and market knowledge over an 8-week period. Our program instructors are Wealth Management Practitioners with 25+ years of experience in the wealth management industry, emphasizing application of knowledge to real-life case situations (Ex. UBS, Credit Suisse, Morgan Stanley, Goldman Sachs, Merrill Lynch).

4. Certified Personal Finance Advisor (CPFA)

Equips Financial Professionals with the knowledge, tools and skillsets to provide sound financial advice and solutions to clients in a professional and easy-to-understand manner. The CPFA certification is attained after attending two interlinked Foundational Programs under PPP Academy as follows, which will enable participants to communicate advisory models effectively, execute influence-based questioning skills to discover and uncover client’s needs, to establish trust, and create more referrals from clients.

- Professional Sales Foundation (PSF)

- Influential Sales Mastery (ISM)

5. Chartered Wealth Manager (CWM)

A globally recognized, highly-reputable certification under the recent merger and partnership with Kornerstone x Trainocate Hong Kong. A comprehensive 4-day (35-hrs) program that covers all aspects of Wealth Management such as investment strategies, life cycle management, intergenerational wealth transfer, relationship management, behavioral finance, alternative products, real estate valuation, and global taxation.

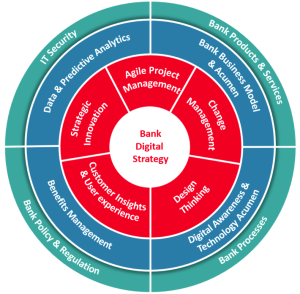

CORPORATE BANKING

CORPORATE BANKING

The Corporate Banking competency wheel is tailored for professionals engaged in providing financial services to corporations and large businesses. This framework covers competencies for credit analysis, risk management, commercial lending, and corporate finance. It aims to develop expertise in structuring and managing complex financial transactions and maintaining strong client relationships.

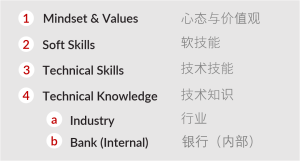

Legend:

6. Certified Credit Risk Analyst (CCRA)

Actively running in China as a 10-day (80-hrs) program which focuses on improving the knowledge and skills of Credit Professionals by knowing and understanding bank’s credit operation methods, effectively avoid credit risks, and help banks establish a sound credit culture and internationally leading credit operation processes, both in the personal and corporate credit departments. The CCRA program allows participants to:

- Interpret and analyze of financial statements and credit evaluation.

- Be equipped with tools in identifying risks, credit marketing and customer relationship management.

- Understand and apply the skills required to evaluate and make recommendations about credit opportunities.

- Learn about credit management professional ethics and legal regulations.

The second level to this certification is the Senior Certified Credit Risk Analyst (SCCRA).

7. Certified SME Lending Analyst (CSLA)

Available in both virtual and instructor-led training in China, this 8-day (60-hrs) program focuses on developing the skills needed to evaluate the credit standing of small and medium-sized enterprises. The CSLA program enables the participants to:

- Understand and analyze financial statements and the credit business to be able to assess the credit-worthiness of an SME.

- Learn how to understand and analyze the SME business model to better understand the business needs.

- Be familiar with the professional ethics and policies of microfinance.

- Learn soft skills (e.g. communication skills) and technical skills (e.g. analysis of financial statements) necessary to assess, develop and serve the target market.

The second level to this certification program is the Senior Certified SME Lending Analyst (SCSLA).

DIGITAL BANKING & FINTECH

Our Digital Banking & Fintech competency wheel specifically addresses the rapidly evolving landscape of financial technology and digital banking services. This framework covers key areas such as digital transformation, blockchain technology, cybersecurity, and innovative financial solutions. It prepares professionals to navigate and lead in the dynamic world of digital finance.

8. Certified Intellectual Property Risk Analyst (CIPRA) >> to be updated

A 5-day (40-hr) program addresses the importance of protecting the technological Intellectual Property (IP) of Financial Institutions with the development of innovation model of the Financial Technology (FinTech) industry. Focusing on educating Financial Professionals on how to understand and analyze the importance of IP risks, to manage and control it to strategically transform IP risk into opportunities of the intangible assets, particularly in relation to FinTech innovations.